[コンプリート!] yield to maturity of a bond excel 287868-Yield to maturity of a bond excel

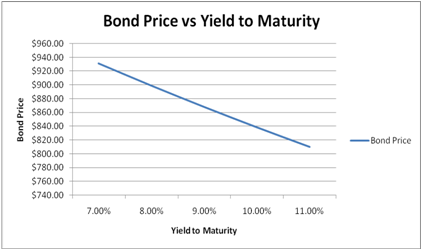

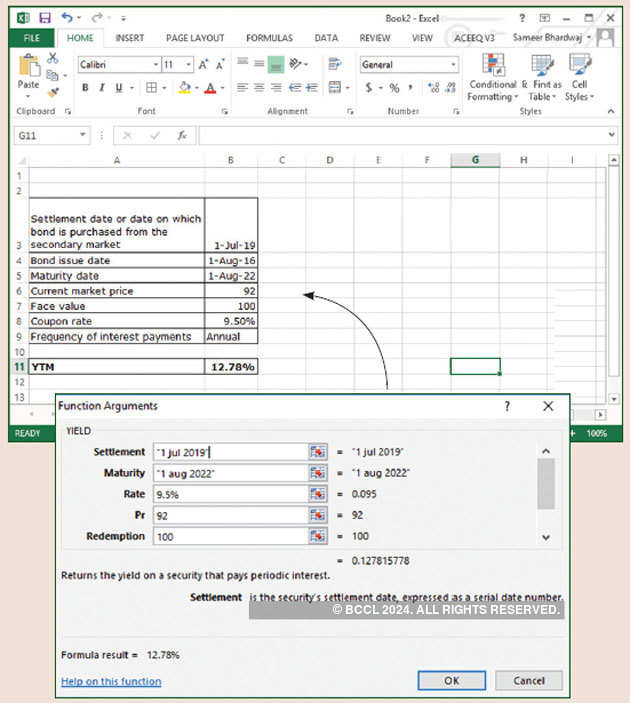

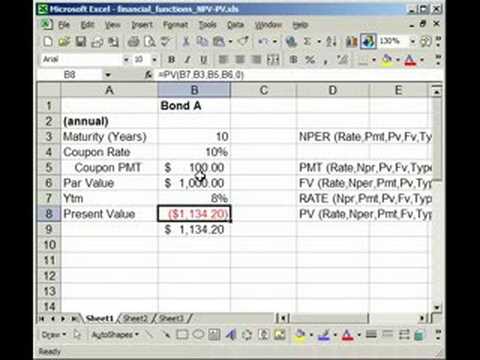

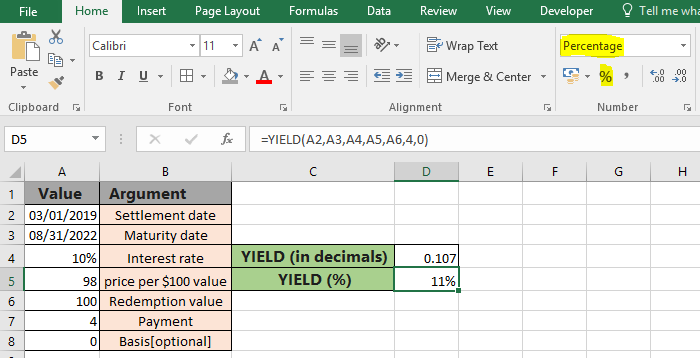

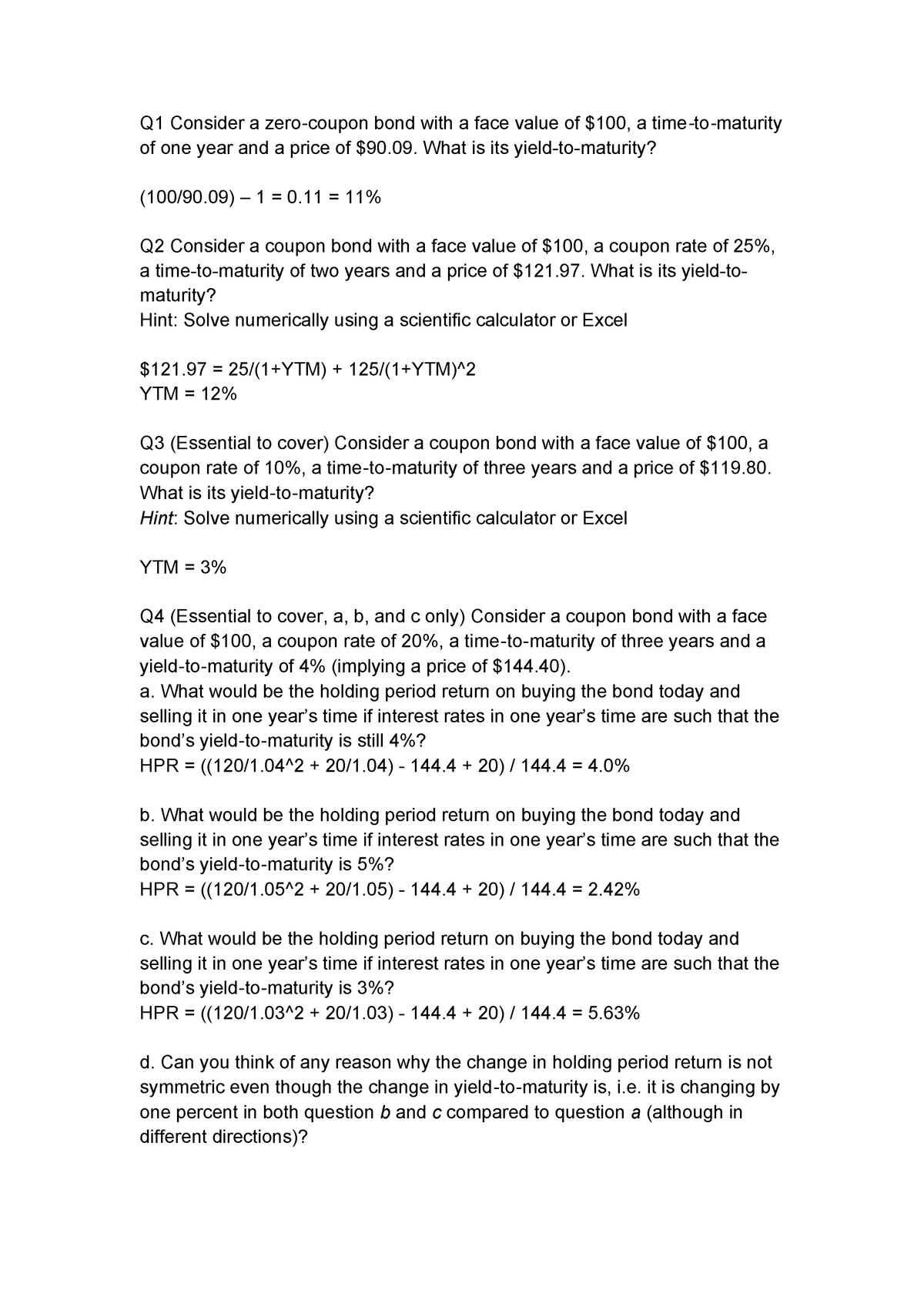

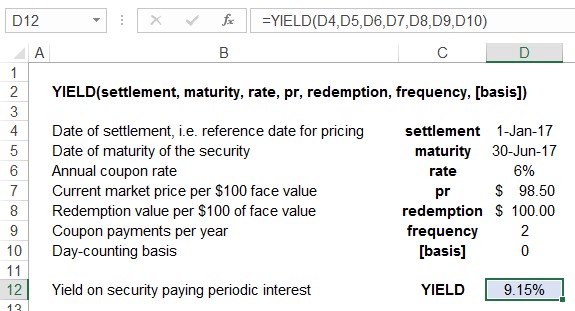

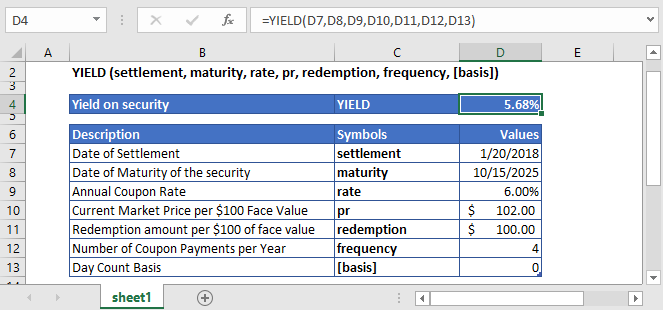

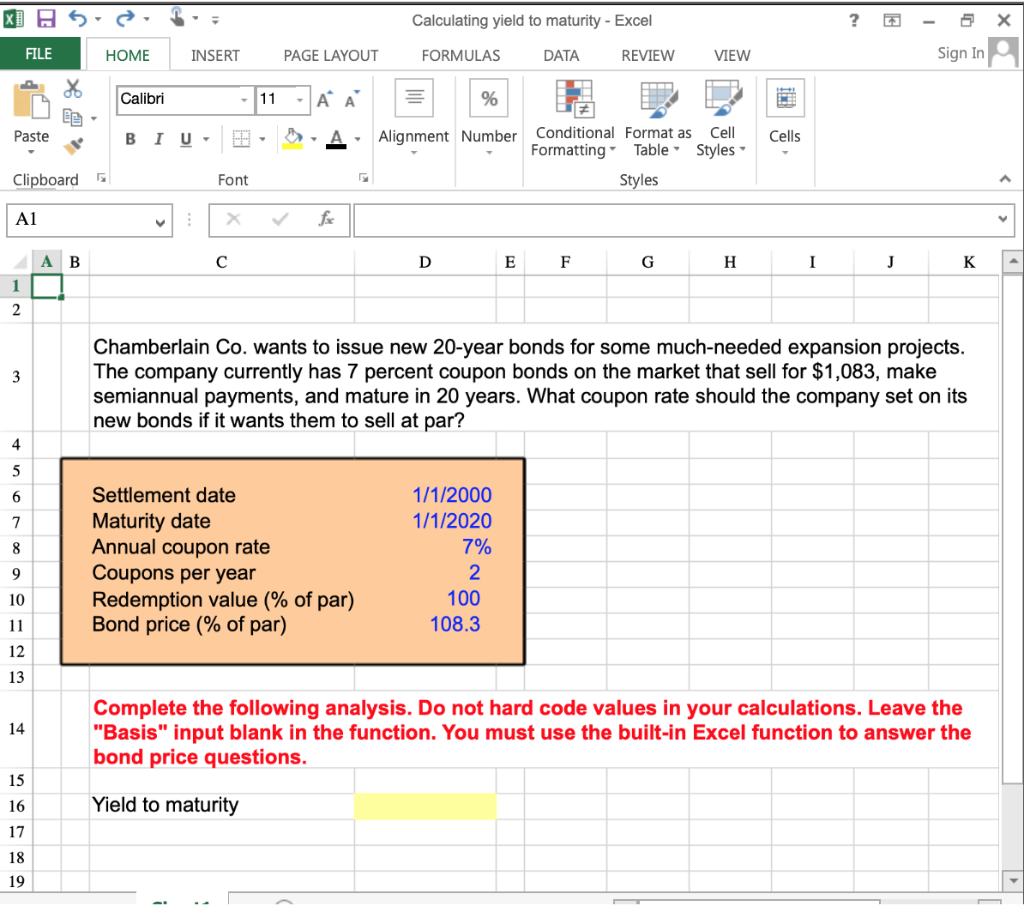

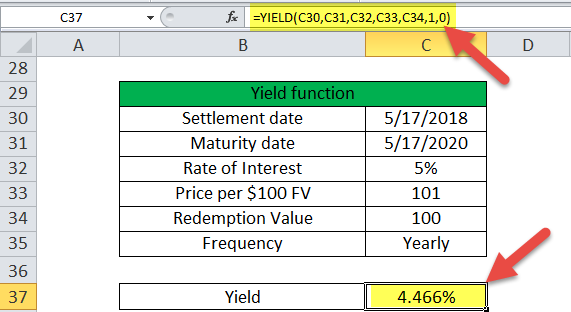

YIELD() Using a spreadsheet to calculate Fixed Rate Bond yield Suppose we have a $1000 face value bond with 6 years to maturity, a coupon rate of 8%, and a price of $911 If the bond makes semiannual payments, what is its YieldToMaturity ?The formula used to calculate the Yield is =YIELD (C4,C5,C6,C7,C8,C9,C10) The YIELD function calculates the yield of the 10year bond YIELD = % As recommended the values of the settlement and maturity date arguments are entered as a reference to the cells containing datesYIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current price There are two common measures of yield current yield and yield to maturity

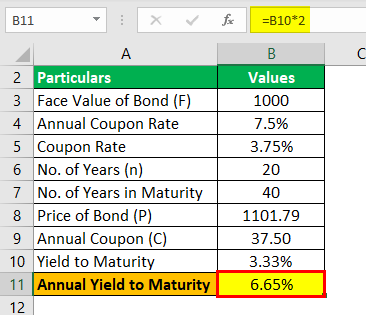

Professional Bond Valuation And Yield To Maturity Spreadsheet

Yield to maturity of a bond excel

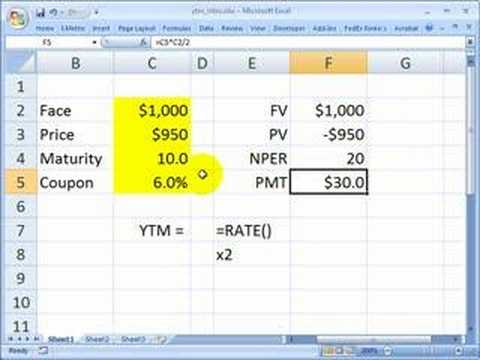

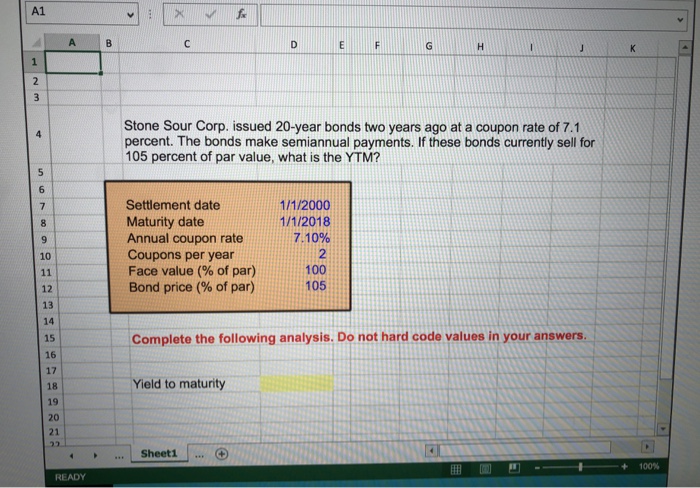

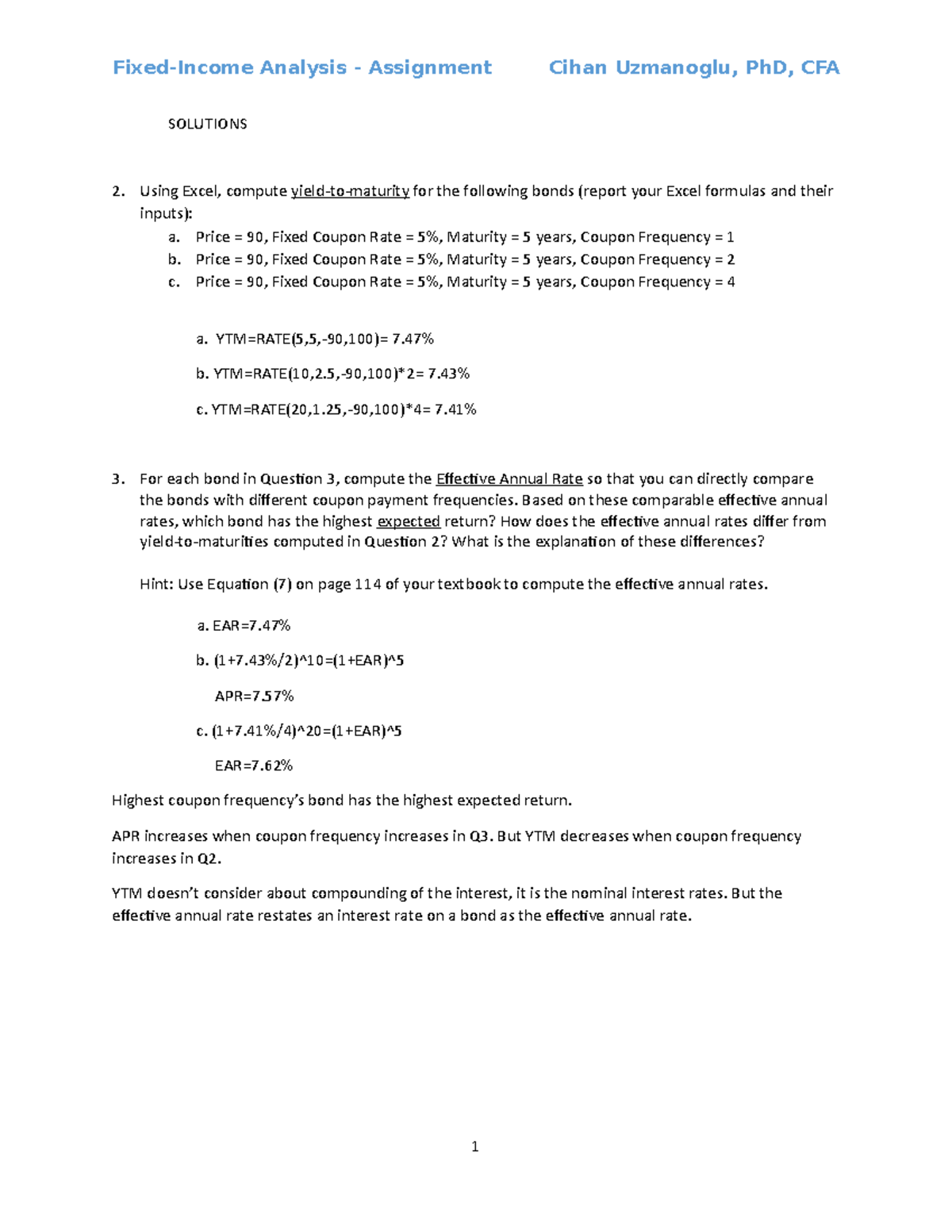

Yield to maturity of a bond excel-N = Years to maturityYield to maturity is calculated using the IRR function on a mathematical calculator or MS Excel Semiannual yield to maturity in this example is calculated by finding r in the following equation r comes out to be 115% Relevant annual before tax cost of debt is just the relevant APR which his 23% (2 × 115%)

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

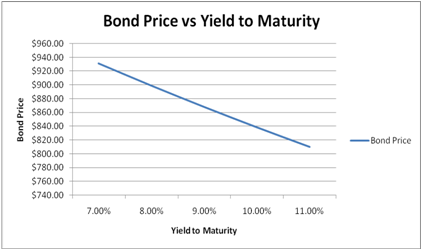

The yield to maturity is calculated using a sum of the present value of the cash flows the same way as pricing a bond For a semiannual payment bond, this is shown mathematically as p = c/ (1 y) 1 c/ (1 y) 2 c/ (1 y) 3 c/ (1 y) n M/ (1 y) n = c (1 (1 y) n) / y M/ (1 y) n whereThe formula for Bond Yield can be calculated by using the following steps Step 1 Firstly, determine the bond's par value be received at maturity and then determine coupon payments to be Step 2 Next, determine the investment horizon of the bond, which is the number of years until its maturity/ Excel Formula for Yield to Maturity The YTM is easy to compute where the acquisition cost of a bond is at par and coupon payments are effected annually In such a situation, the yieldtomaturity will be equal to coupon payment However, for other cases, an approximate YTM can be found by using a bond yield table

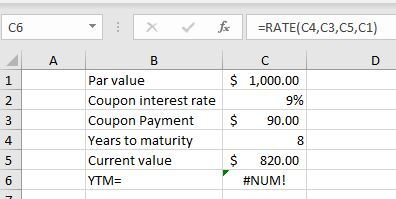

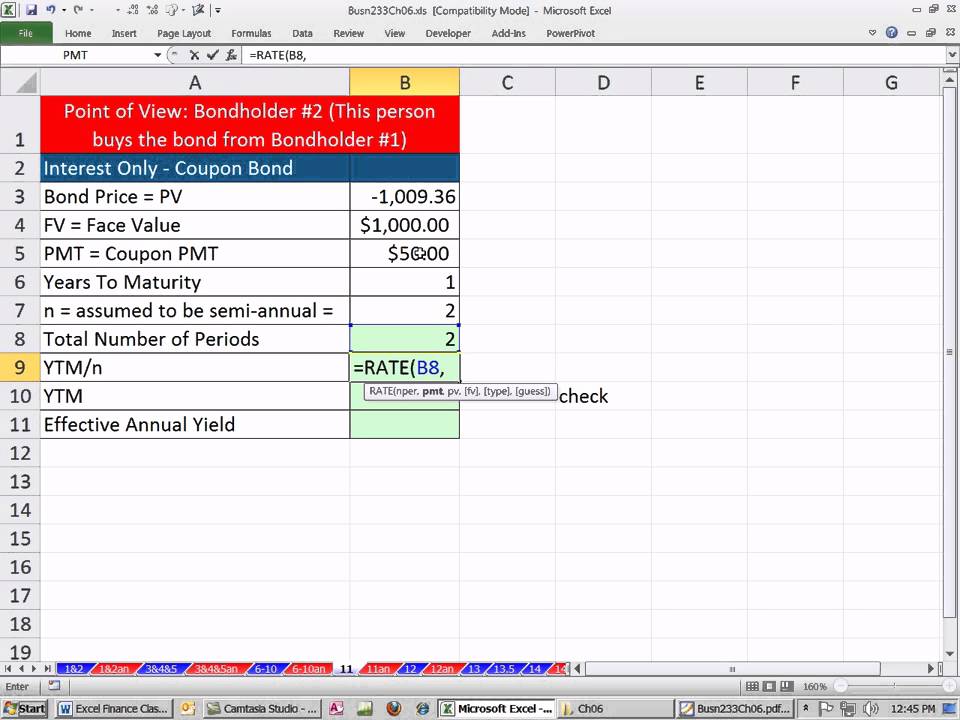

The yield to maturity of a bond isn't given by a simple, explicit equation – you need iterative methods to backsolve the bond pricing formula Excel's RATE function, for example, iteratively calculate bond yields However, you might want to compute this quantity with VBA instead But why would you use VBA when RATE already exists?How to Use Bond Yield to Maturity Calculator There are things you should calculate to get the final result of Bond Yield to Maturity Calculator, such as the Subtract the bond purchase price from its par value (you will get the discount) Use bond's year to maturity to divide the result of firstA sample containing years to maturity and yield for 40 corporate bonds is contained in the Excel Online file below Construct a spreadsheet to answer the following questions х Open spreadsheet a

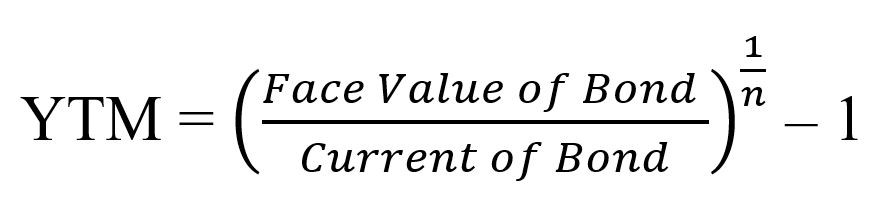

Yield to Maturity, YTM Definition The yield to maturity (YTM) of a bond is the internal rate of return (IRR) if the bond is held until the Formula To solve the equation above, the financial calculator or MS Excel is needed Annual YTM = (1 Semiannual Example A private investor hasYield to Maturity(YTM) can be described as total anticipated return which an investor will earn on his/her investments starting from date of investment till the ultimate due date of maturity (generally calculated for bonds, debentures, etc), YTM is generally confused with annual rate of return which is different from YTM or else YTM can be described as discount rate at which sum of all future cash flows from bond will be equal to bond priceUse Basis of ACTUAL/ACTUAL Days in a year 365 Tenor in years 6 Settlement date 3 Jan Maturity date 1 Jan 26 Annual coupon rate 8% Bond price

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

What Is The Yield To Maturity Ytm Of A Zero Coupon Bond With A Face Value Of 1 000 Current Price Of 0 And Maturity Of 4 0 Years Recall That The Compounding Interval

The calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturityEstimated Yield to Maturity Formula However, that doesn't mean we can't estimate and come close The formula for the approximate yield to maturity on a bond is ( (Annual Interest Payment) ( (Face Value Current Price) / (Years to Maturity) ) ) / ( ( Face Value Current Price ) / 2 ) Let's solve that for the problem we pose by default in the calculator Current Price $9;Draw a time line for a 3year bond with a coupon rate of 8% per year paid semiannually The bond has a face value of $1,000 The bond has three years until maturity and it pays interest semiannually, so the time line needs to show six periods The bond will pay 8% of the $1,000 face value in interest every year

Bond Yield To Maturity Excel Formula Cells In Blue Are Course Hero

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

The YIELD function syntax has the following arguments Settlement Required The security's settlement date The security settlement date is the date after the issue date when the security is traded to the buyer Maturity Required The security's maturity date The maturity date is the date when the security expires Rate Required The security's annual coupon rateThe YIELD function calculates the yield of the 10year bond YIELD = % As recommended the values of the settlement and maturity date arguments are entered as a reference to the cells containing dates YIELD in Google SheetsThe YIELD function syntax has the following arguments Settlement Required The security's settlement date The security settlement date is the date after the issue date when the security is traded to the buyer Maturity Required The security's maturity date The maturity date is the date when the security expires Rate Required The security's annual coupon rate

Yield To Maturity Ytm Calculator

Yield To Maturity Formula Step By Step Calculation With Examples

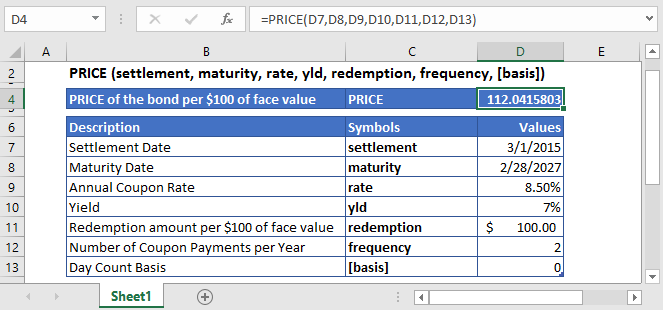

PV = P ( 1 r ) 1 P ( 1 r ) 2 ⋯ P Principal ( 1 r ) n where PV = present value of the bond P = payment, or coupon rate × par value ÷ number of payments per year r = requiredCompany 1 issues a bond with a principal of $1,000, an interest rate of 25% annually with maturity in years and a discount rate of 4% The bond provides coupons annually and pays a couponYield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return Formula = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue date

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

Bond Yield to Maturity Calculator simply refers to the return rate investors will get when they buy a bond within the most updated market price, and hold it up to maturity Meanwhile, YTM (Yield to Maturity) is generally defined as an index used to measure the bond's attractivenessSolution Use the belowgiven data for calculation of yield to maturity We can use the above formula to calculate approximate yield to maturity Coupons on the bond will be $1,000 * 8%, which is $80 Yield to Maturity (Approx) = (80 (1000 – 94) / 12 ) / ( (1000 940) / 2) Yield to Maturity will be –Years to Maturity 10

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Bond Pricing Valuation Formulas And Functions In Excel Youtube

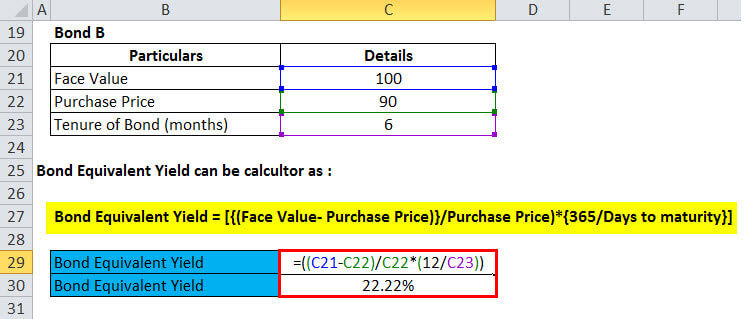

Yield to maturity is an interest rate that, when used to calculate the present value of each cash flow in the bond, returns the price of the bond as the sum of theIn this video, I show how to find YTM of a bond in Excel In this video, I show how to find YTM of a bond in ExcelAn investor needs to know the bond equivalent yield formula It allows the investor to calculate the annual yield of a bond sold at a discount Bond Equivalent Yield Formula = (Face value – Purcase Price) / Purchase Price * 365/d Here, d = days to maturity

Solved You Find A Zero Coupon Bond With A Par Value Of 1 Chegg Com

How To Calculate Bond Price In Excel

A sample containing years to maturity and yield for 40 corporate bonds is contained in the Excel Online file below Construct a spreadsheet to answer the following questions х Open spreadsheet aHow to Calculate Bond Yield to Maturity Using Excel Open a Blank Excel Spreadsheet In Excel click "File" then "New" using the toolbar at the top of the screen Set Up the Assumption Labels Enter the Dates Enter the settlement date into cell B2 The settlement date is when an investor buys theYield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity It is expressed as a percentage and tells investors what their return on investment will be if they purchase the bond and hold on to it until the bond issuer pays them back

How To Use The Yield Function In Excel

How To Use The Excel Mduration Function Exceljet

V Bond = 95 =10/(1r) 110/(1r) 2 This may be solved using a trial and error process or the equation may be solved for in EXCEL using the GOAL SEEK functionality i Trial and error process for calculating YTM of a bond 1 Start with two points r= 0% and r= 15% When r=0%, V Bond – Discounted Value = Net Present Value (NPV) = 2500 When r=15%, NPV = 300Calculating bond's yield to maturity using excel Calculating bond's yield to maturity using excelThe discount rate, in this case, is known as the yield to maturity (YTM) We can calculate bond yields using the RATE function in Excel This feature takes care of the iterations and calculates the bond yield in one go Example Bond Yield An investor purchased a 5year 4% coupon bond with annual payments at a price of %

Quant Bonds Between Coupon Dates

Solved Calculate The Ytm Using Excel Formula And Cells S Chegg Com

F = Face value;My school book shows that the yield to maturity = dollar amount of annual interest face value market value / the number of period of times which = market value face vale / 2 = 60 1000 900 / 10 which again = 900 1000 / 2 which equals 0074 or 7 4 I have no idea where the number 2 comes from, and why it is usedThe equation below gives the value of a bond at time 0 The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount Coupon payment) have been discounted at the yieldtomaturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond)

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Excel Help Calculating Yield To Maturity For A Bond

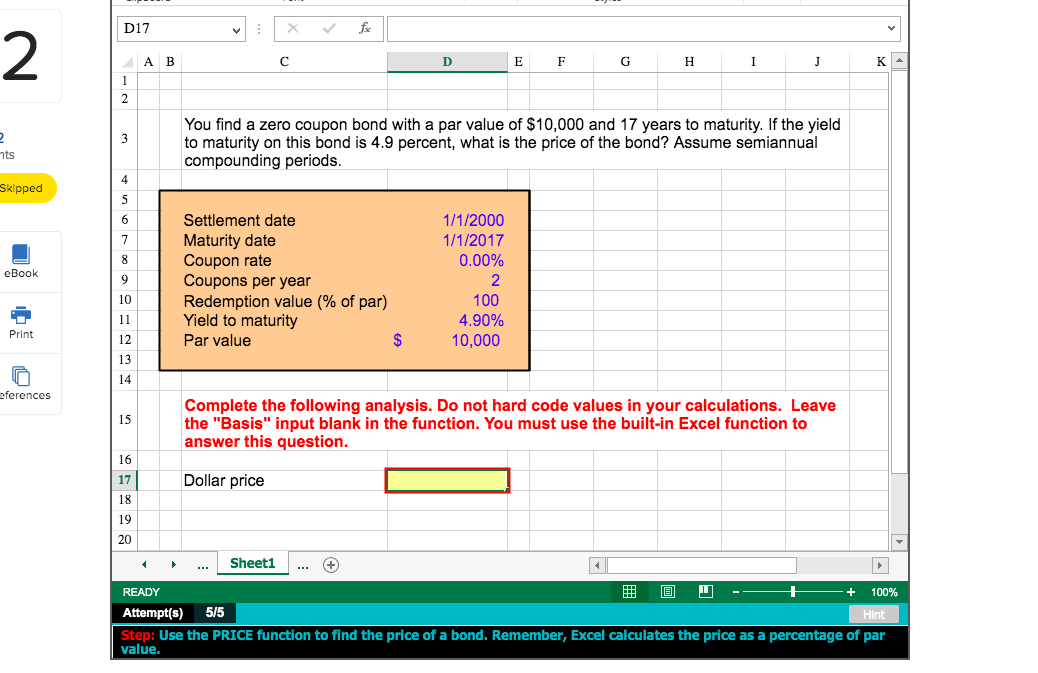

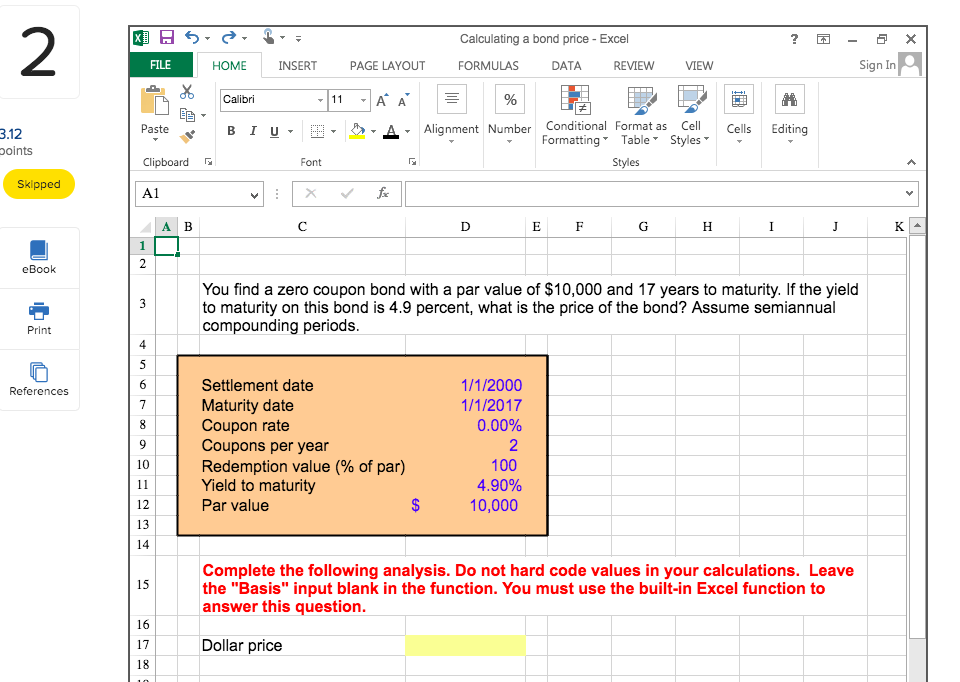

Before the maturity date, the bondholder cannot get any coupon as below screenshot shown You can calculate the price of this zero coupon bond as follows Select the cell you will place the calculated result at, type the formula =PV (B4,,0,B2) into it, and press the Enter keyThe discount rate, in this case, is known as the yield to maturity (YTM) We can calculate bond yields using the RATE function in Excel This feature takes care of the iterations and calculates the bond yield in one go Example Bond Yield An investor purchased a 5year 4% coupon bond with annual payments at a price of %Freeware 10 Excel Sheet Unlocker Downloads at Download That The Bond Yield to Maturity calculator for Excel and OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity Bond Yield Calculator, Corrupt xlsx2csv, BulkPDF

Bond Swap Horizon Analysis Calculator Excel Cfo

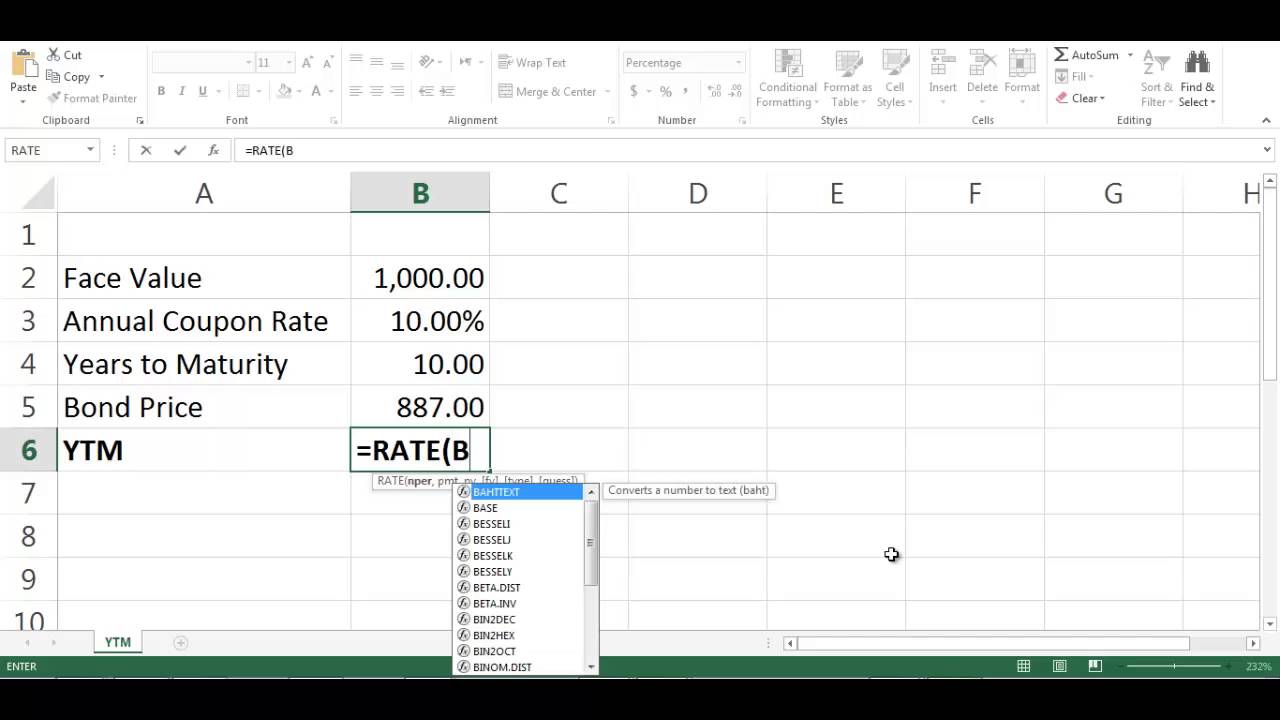

Problem Set 1 Tutorial Question Studocu

Creating a Yield Curve from bond prices using Deriscope Using the Deriscope interface to QuantLib, a single ds () function suffices to create a yield curve object out of bond prices You may type the function by hand or – more conveniently – let the wizard generate it= Yield to Maturity (YTM) To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bond Example of Calculating Yield to Maturity For example, you buy a bond with a $1,000 face value and 8% coupon for $9001) assume a yield maybe the face rate on the bond, it doesn't really matter, and enter it in a convenient cell (you will be referring to it a lot, and will need to have it in a cell for later don't hard code it in formulas) 2) calculate the term to maturity Mat Date Settlement Date in days

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Please Show Work In Excel Formula Thanks G A C E F N J 1 2 Union Local School District Has Bonds Outstanding With A Co Homeworklib

The Yield to Maturity is a common yardstick that a bond investor uses to measure the value of a bond It is basically the rate of return, sometimes referred to the internal rate of return, when a bond is held to maturity In simple words, it is the interest rate you will receive if you hold the bonds to the maturity date without selling it in the marketThus, yield to call (YTC) can be defined as the internal rate of return (IRR) if a bond is expected to be redeemed before the maturity date Yield to call can also be defined as the discount rate at which the present value of all coupon payments (left to call date) and the call value are equal to the bond's current market priceUse Basis of ACTUAL/ACTUAL Days in a year 365 Tenor in years 6 Settlement date 3 Jan Maturity date 1 Jan 26 Annual coupon rate 8% Bond price

How To Use The Excel Yield Function Exceljet

Homework 2 Solutions 2 Copy Studocu

A sample containing years to maturity and yield for 40 corporate bonds is contained in the Excel Online file below Construct a spreadsheet to answer the following questions х Open spreadsheet aOn this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on timeHow to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function Suppose, you got an offer to invest in a bond Here are the details of the bond Par Value of 2) Using Excel's IRR Function

Microsoft Excel Bond Valuation Tvmcalcs Com

Calculating Bond S Yield To Maturity Using Excel Youtube

It's difficult to calculate the exact YTM, but in the formulas below we'll look at how you can calculate the approximate yield to maturity of a bond Yield to Maturity Formula YTM = \dfrac{ C \dfrac{FP}{n} }{ \dfrac{FP}{2}} C = Coupon/interest payment;YIELD() Using a spreadsheet to calculate Fixed Rate Bond yield Suppose we have a $1000 face value bond with 6 years to maturity, a coupon rate of 8%, and a price of $911 If the bond makes semiannual payments, what is its YieldToMaturity ?

Yield To Maturity Formula Step By Step Calculation With Examples

Yield To Maturity Calculation In Excel Example

Solved X 5 X Home Calculating Yield To Maturity Exc Chegg Com

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Quant Bonds Between Coupon Dates

Duration And Convexity With Illustrations And Formulas

How To Use The Excel Tbillyield Function Exceljet

How To Calculate Bond Price In Excel

Bond Yield Formula Calculator Example With Excel Template

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Bonds Part Iv Bond Calculator Code Financial Modeling History

Yield Formula Excel Example

1

Best Excel Tutorial How To Calculate Yield In Excel

Excel Ytm Calculator Calculator Spreadsheet Free Download

Yield Formula Excel Example

1

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Bond Equivalent Yield Formula Calculator Excel Template

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Yield To Maturity Formula Step By Step Calculation With Examples

Yield To Maturity Ytm Overview Formula And Importance

Bond Equivalent Yield Formula Calculator Excel Template

Excel Yield Function

Q Tbn And9gcspsw0gvryuir4hbunmr9ryyqtt9uvaiwo4js Vmypouh4p4lqk Usqp Cau

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Solved Calculate Current Bond Price Using Excel Formula A Chegg Com

How To Calculate Bond Price In Excel

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

How To Calculate Pv Of A Different Bond Type With Excel

Best Excel Tutorial How To Calculate Yield In Excel

Solved Calculating Yield To Maturity Excel Home Insert Chegg Com

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Yield To Maturity Ytm Definition Formula And Example

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield Function In Excel Calculate Yield In Excel With Examples

Excel Yield Function Double Entry Bookkeeping

Bond Yield To Maturity Calculator Printer Driver Printer Batch File

Vba To Calculate Yield To Maturity Of A Bond

Microsoft Excel Bond Valuation Tvmcalcs Com

Learn To Calculate Yield To Maturity In Ms Excel

Yield To Maturity Approximate Formula With Calculator

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Learn To Calculate Yield To Maturity In Ms Excel

Bond Valuation And Yield To Maturity Using Excel Youtube

Yield To Maturity And Duration Calculator

Bond Yield To Maturity Calculator Exceltemplates Org

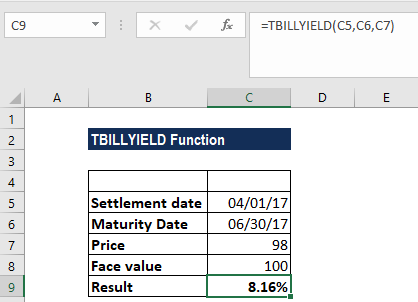

Tbillyield Function Formula Examples Calculate Bond Yield

Best Excel Tutorial How To Calculate Yield In Excel

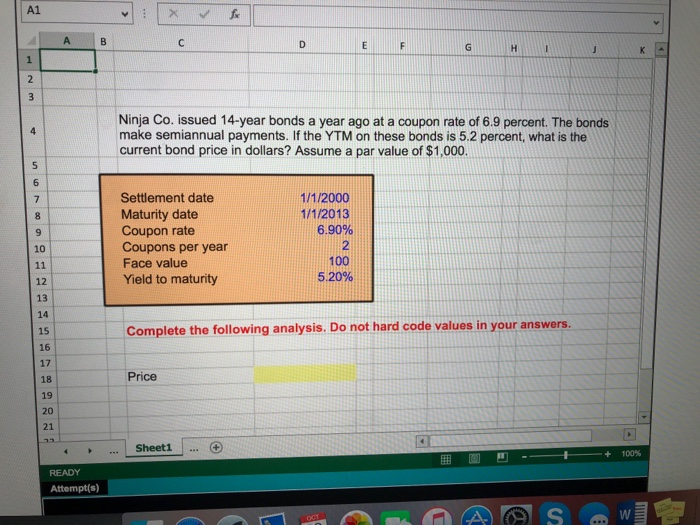

Compute The Current Bond Price Answer Must Be In Excel Formula Ninja Co Issued 14 Year Bonds Homeworklib

Professional Bond Valuation And Yield To Maturity Spreadsheet

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Http Www Cass City Ac Uk Data Assets Pdf File 0015 I 1 Pre Calc Pdf

Yield Function Formula Examples Calculate Yield In Excel

Finding Yield To Maturity Using Excel Youtube

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Bond Duration Formula Excel Example

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

A What Is The Maturity Of The Bond In Years Maturity Of The Bond 2 10 Years Course Hero

Bond Net Yield To Maturity Calculator Eloquens

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Best Excel Tutorial How To Calculate Yield In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Free Bond Valuation Yield To Maturity Spreadsheet

Bond Yield Formula Calculator Example With Excel Template

Chapter 4 Cengage Learning

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Bond Formula How To Calculate A Bond Examples With Excel Template

Bond Price Calculator Present Value Of Future Cashflows Dqydj

How To Calculate Pv Of A Different Bond Type With Excel

Floating Rate Notes Frn In Excel Understanding Duration Discount Margin And Krd Resources

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Deriving The Bond Pricing Formula

Professional Bond Valuation And Yield To Maturity Spreadsheet

コメント

コメントを投稿